What’s the state of student loans for American higher ed, and how is that situation likely to develop in the future? A new Bloomberg investigation yields some important and disturbing insights.

I’ll put out some key details here.

…and just to deflate any narrative tension you might be experiencing, dear reader, there aren’t many surprises. If you’ve been paying attention to student loans, that is.

The total amount of students loans is now $1.5 trillion, by Bloomberg’s count. (When will we hit $2 trillion, 2025?) Interest rates are rising, too.

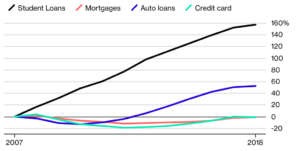

Recent growth in student loans (2007 on) has outpaced all other kinds of consumer debt, by far:

Bloomberg also joins the rest of us in finding student loans exerting a downward pressure on the larger economy:

As young adults struggle to pay back their loans, they’re forced to make financial concessions that create a drag on the economy. Student debt has delayed household formation and led to a decline in home ownership. Sixteen percent of young workers aged 25 to 35 lived with their parents in 2017, up 4 percent from 10 years prior…

It’s a question of depressed demand, since loan-holders are devoting more dollars to paying down debt than did previous generations:

“You have a whole generation of people that have a significant amount of student loans and its crimping demand for other goods and services,” said Ira Jersey, the chief U.S. interest rate strategist for Bloomberg Intelligence. “As people live with their parents, or cohabit with a non-partner, millions of houses and apartments aren’t being purchased. Neither is Wi-Fi or that extra sofa. We think this is having a significant impact on the economy.”

Meanwhile, student loans are also more likely to be behind in getting paid back:

Student loan debt currently has the highest 90+ day delinquency rate of all household debt. More than 1 in 10 borrowers is at least 90 days delinquent, while mortgages and auto loans have a 1.1 percent and 4 percent delinquency rate, respectively…

What does this mean for the future?

First, people are holding this debt now. There isn’t any real conversation about debt forgiveness. So that debt bolus is just stuck in our society until it gets paid off, or until the owners die (and maybe the burden isn’t passed onto survivors; maybe not). In other words, the giant American total student loan debt is already baked into the economic pie, no matter what we do for the next student cadres. All of its results–the constraints on human lives, the macroeconomic pressure–are going to keep hitting us for quite some time, even if new tuition bills aren’t rising as quickly as they used to.

Second, this loan specter will continue to pressure college curricula. Listen carefully to the Bloomberg discussion:

“There’s a systemic problem in the student loan market that doesn’t exist in the other asset classes,” [John Hupalo, founder and chief executive officer of Invite Education, an education financial planner] said. “Students need to get a job that allows them to pay off their debt. The delinquency rate will rise as long as students aren’t graduating with degrees that pay back that cost.”

“as students aren’t graduating with degrees that pay back that cost.” Did you catch that? It’s not college per se, and not the type or reputation of (non-profit) university, but the course of study.

For students, we already know that debt dread is shaping the classes and majors they take. For institutions, what does this intelligence tell a curriculum committee considering a new major in, say, a humanities field? How does it inform development officers and presidents asking donors to fund a chair in, say, petroleum engineering? If a campus undertakes an academic program prioritization exercise, what role will perceptions of future earning versus debt play in determining which programs to fold, and which to expand?

Third, the Bloomberg analysis foretells continued challenges for the for-profit education sector.

Delinquencies escalated in the wake of the Great Recession as for-profit colleges pitched themselves as an end run around low-paying jobs, explained Judith Scott-Clayton, a Columbia University associate professor of economics and education. But many of those degrees ultimately proved useless, leaving graduates with debt they couldn’t pay back. [hyperlink in original]

I’m not sure how that sense will play against the Trump administration’s pro-business thinking.

[Editor’s Note: This blog was originally posted on Bryan Alexander’s blog on October 20, 2018.]

Check out this webinar

The Future Trends Forum is an open video conversation about the future of higher ed. Each week, a different guest—an inspiring expert, visionary, practitioner, or researcher—talks about their area of interest. Past guests include Audrey Watters, Martin Dougiamas, Anya Kamenetz, George Siemens, Casey Green, and Will Richardson. Check out past recordings here.

- Coalition looks to accelerate LER adoption in higher ed - May 1, 2024

- Selective universities won’t be disrupted - April 30, 2024

- Fully Homomorphic Encryption can revolutionize education - April 29, 2024