In 2014, taxis had 76 percent of the ride-hailing market for business travelers. Just four years later, taxis have only 7 percent of that market, with Uber and Lyft taking the other 93 percent.

The forces of disruption can be fast and furious. They have attacked business verticals throughout the economy. Disruption displaces an existing market, industry, or technology and produces something new, more efficient, and worthwhile, according to Harvard Business School professor Clayton Christensen. Disruptors’ favorite targets are industries that are vulnerable on affordability and convenience. For higher education, that description strikes close to home.

Related content: Using analytics to increase student success

Disruption is simultaneously destructive and creative, and it is happening in higher education right now. Sixty-six percent of higher education leaders understand this and believe that the traditional business model in higher education is no longer sustainable, according to a Kaufman Hall survey.

These leaders don’t expect the current business model to remain viable for more than five to 10 years. Across all institution types and endowment levels, confidence in the strength of the current business model has dropped, with negative sentiment fueled by:

• Intense competition for a declining number of students

• The emergence of “free” or “nearly free” college programs offered by employers

• Endowments that return only slightly more than average spending rates

• Rising costs to provide education — including tuition discount rates approaching 50 percent

But it’s not too late for higher education institutions to adapt and thrive in this disruptive environment. Linking the institution’s strategic plan to its financial plan and capital planning processes is a significant step toward long-term viability and is a strategy that colleges and universities across the U.S. should prioritize.

A model for strategic financial planning in higher ed

Integrated strategic and financial planning practices help institutions better connect their strategic thinking with operational plans, understand their risks, and more quickly and intelligently adapt to change.

These are critical capabilities at a time when just 18 percent of higher education leaders are very confident in their team’s ability to quickly and easily make adjustments to strategies and plans, the Kaufman Hall survey shows. To move the needle on confidence and performance, leaders must shift their focus from short-term revenue and expense budgeting to a more comprehensive planning approach.

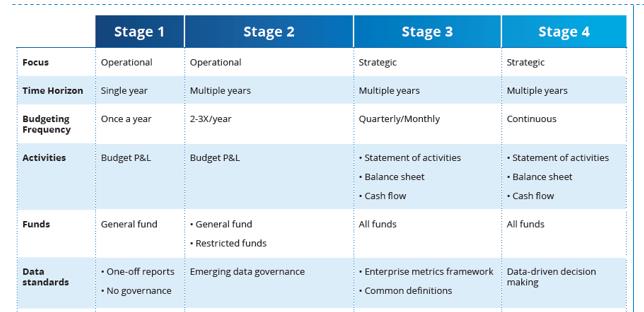

To be successfully implemented, integrated planning efforts must incorporate relevant perspectives from the organization’s existing processes and culture, as well as industry best practices and traditional business and corporate finance techniques. As colleges and universities progress toward achieving complete integration, they will likely pass through four stages of financial planning maturity (see EXHIBIT ONE). Our experience suggests that many higher education institutions have evolved to Stage 1 or Stage 2, the most basic stages of financial planning in higher ed:

In Stage 1, colleges and universities often limit their financial planning to operational budgeting, effectively preventing their ability to perform multiyear planning. As they move to Stage 2, institutions extend forecasts and planning by quarters or years from the annual operating budget. While this is certainly a step forward, the focus on operational budgeting continues to limit longer-term visibility into their institution’s financial health. Stage 1 and 2 institutions struggle to align their financial plans with the institution’s strategic vision and tuition and grants planning. As a result, they cannot adequately and proactively plan for the changes ahead.

EXHIBIT ONE:

The 4 Stages of Financial Planning Maturity

Source: Kaufman, Hall and Associates, LLC.

As processes mature to what we refer to as Stages 3 and 4, long-range financial planning becomes easier and more accurate. This is where the magic happens.

In Stage 3, financial planning in higher ed is more strategic, with a timeline of multiple years. Budgeting activities/updates are on a monthly or quarterly rhythm. The primary goal is to connect strategic planning with a robust, long-range financial plan (see EXHIBIT TWO).

In Stage 4, the institution’s strategic financial planning or rolling forecasting process directly connects to capital budgeting and operational budgeting. Grants planning and tuition planning are tightly integrated with overall institutional planning — so are large capital and strategic initiatives and operating targets and ratios.

EXHIBIT TWO:

Characteristics of Financial Planning Maturity in Higher Ed

Source: Kaufman, Hall and Associates, LLC.

Our research shows that 40 percent of institutions fail to include both large capital and strategic initiatives, in the development of operating targets and ratios included in their integrated plans. These exclusions, and the resulting disjointed set of processes, leave these institutions vulnerable to disruption from new entrants as they are less prepared to adjust to the pressures of a rapidly changing business environment.

The right moves for long-term success

How can leaders proactively improve strategic and financial planning in higher ed? Designing a framework for tightly integrated strategic and financial planning is key. Here are three key steps and their real-world applications at leading colleges and universities.

1. Build an analytic foundation. Institutions in the earliest stages of financial planning maturity focus on one-year operational budgets based purely on history or user input. This bottoms-up, incremental budgeting approach is labor intensive and isn’t easily informed by changes in strategy prompted by a transformative environment.

Achieving next-level financial planning maturity requires:

• Access to relevant, timely data to make informed decisions around performance, work units, resources, and the efficacy of specific programs or majors

• Technology to support more frequent forecasting

• Disciplined approaches to sharing data among planning functions for transparency across the institution

Building an analytic foundation for financial planning maturity doesn’t necessarily require additional staff. Modern financial planning software for higher education can drive greater efficiency by streamlining budget processes and aligning them with planning processes. Shorter, well-defined budgeting cycles can also empower leaders to allocate resources more strategically based on real-time data.

At Quinnipiac University, a private university with 10,000 students in Connecticut, departments used to rely on nonstandard, siloed planning and reporting processes. Staff aggregated data using spreadsheets. This prevented leaders from accessing timely analytics and reports to make strategic decisions around 100 programs across multiple campuses.

Quinnipiac now uses an integrated financial planning process, which includes moving from one-year to multi-year planning that aligns capital, operational, and labor planning. Quinnipiac also replaced spreadsheets with a software platform that accurately and rapidly creates dashboards and other visually enhanced reports for senior leaders and the board.

Tools used by Quinnipiac include:

• Integrated planning and budgeting software, critical for data standardization and streamlined data sharing

• A flexible planning and budgeting tool that supports data-based decision making and heightens transparency

Implementation of this disciplined, data-driven approach at Quinnipiac has led to many benefits, including helping the finance team identify the right time to refinance the institution’s $500 million debt portfolio by monitoring fixed- and variable-rate debt indicators in taxable and tax-exempt markets.

The impact? Savings of millions of dollars in debt-service payments. Today, Quinnipiac leverages a strong analytic foundation to drive critical decision-making processes, and has had its success story featured in Business Officer magazine.

2. Use data to determine the right opportunities for improvement. Leading colleges and universities use a data-driven, structured approach to assess and select the portfolio of opportunities worthy of investment. It’s a process that is structured, disciplined, and calendar-driven, with specific planning and review tasks occurring during predetermined months. These defined tasks culminate in decisions around program strategies, financing of those strategies, and strategic allocation of capital and other resources.

A quantitative fact base should guide strategic decision making. Data-rich assessments should focus on:

• The institution’s current position in its market

• The competitive landscape, now and in the future

• The institution’s strengths and weaknesses related to the programs it wishes to provide

Thoughtful design of the structure for decision-making is key. For example, the University of North Texas Health Science Center uses a process for making investment decisions that involves scoring and ranking the opportunities based on their potential contribution to the institution’s strategic and financial goals. This enables leaders to select the optimal mix, or portfolio, of projects that will advance the university’s strategic plan while attaining financial performance targets (e.g., operating income, margin, cash). Ideas that are not consistent with the key strategic and financial objectives are likely to be scored low and ranked low during the decision-making process — thus, they are unlikely to be funded, no matter how interesting they might appear.

3. Develop rigorous goal setting and performance monitoring. Colleges and universities with mature financial planning models set financial goals consistent with national standards for similar institutions or those with debt ratings (i.e., access to capital) they desire to attain. The institution’s financial targets should be based on credible projections that reflect a healthy balance between top-down expectations and bottom-up requirements. The underlying assumptions driving projections of future outcomes should be in line with the institution’s past, actual performance as well as relevant industry benchmarks, adjusted for known future changes.

At institutions that employ rigorous goal setting, senior executives set targets that encourage managers to stretch toward breakthrough thinking. Progress toward meeting these targets is shared widely, with dashboard scorecards created and distributed for long- and short-term initiatives. When performance falls below expectations, leaders investigate what went wrong, make necessary modifications, or deploy exit strategies guided by data.

The University of Vermont, a public research university with an operating budget in excess of $650 million, recently determined the need for increased transparency, accessibility, and consistency in its budgeting processes. Historically, the university had relied on a centralized budgeting process, with the Provost and President determining unit budget allocations. In 2015, the university transitioned to an incentive-based budgeting model: responsibility-center management.

In 2016, the university implemented a software solution for integrated planning and reporting, including multi-year budgeting and salary planning. Leaders and staff gained a better understanding of the university’s resource risks and opportunities, empowering more informed decision-making and associated accountability. Today, the University of Vermont uses advanced data analytics to quantify challenges and evaluate solutions. It’s an uncommon approach that attracts attention and continues to drive improved performance, with new revenue sources and the ability to more actively manage costs.

Steps toward survival

Given the magnitude of challenges faced by higher education institutions and the level of disruption being witnessed already, the need for tightly integrated strategic and financial planning in higher ed has never been greater. Colleges and universities with mature financial planning processes already realize short-term wins, such as new revenue sources and more effective cost management. Embracing the move toward more integrated strategic financial planning will protect an institution’s viability and its relevance for years to come.

- Using real-world tools to prepare students for the workforce - April 18, 2024

- 8 top trends in higher education to watch in 2024 - April 16, 2024

- Defining a path to equitable AI in higher education - April 12, 2024