Even in the unlikely case that you actually are bad at math, please don’t say it

[1]Let’s start with a multiple-choice question: Imagine that you’re at a party, and you’ve just struck up a conversation with a dynamic, successful businesswoman. Which of the following are you most likely to hear her say during the course of your conversation?

[1]Let’s start with a multiple-choice question: Imagine that you’re at a party, and you’ve just struck up a conversation with a dynamic, successful businesswoman. Which of the following are you most likely to hear her say during the course of your conversation?

A. “I really don’t know how to read very well.”

B. “I can’t write a grammatically correct sentence.”

C. “I’m awful at dealing with people.”

D. “I’ve never been able to think logically.”

E. “I’m bad at math.”

We all know that the answer is E, because we’ve heard it so many times. Not just from businesswomen and businessmen, but from actors and athletes, construction workers and sales clerks, and sometimes even teachers and CEOs.

Somehow, we have come to live in a society in which many otherwise successful people not only have a problem with mathematics but are unafraid to admit it. In fact, it’s sometimes stated almost as a point of pride, with little hint of embarrassment.

It doesn’t take a lot of thought to realize that this creates major problems. Mathematics underlies nearly everything in modern society, from the daily financial decisions that all of us must make to the way in which we understand and approach global issues of the economy, politics, and science.

To take a simple example, consider the recent recession and financial crisis, which is still affecting the global economy today. The clear trigger for the recession was the popping of the real estate bubble, which ignited a mortgage crisis. But what created the bubble that popped?

(Next page: How simple math could have prevented our financial crisis)

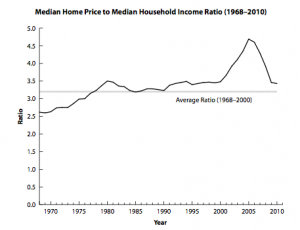

Take a look at the figure below, which shows one way of looking at the housing bubble. The graph shows the ratio of the “median home price to medium household income.” Notice that this ratio remained close to 3 for decades, meaning that on average, a family with income of $50,000 per year would purchase a home costing about 3 times $50,000, or $150,000.

Then, from about 2001 to 2007, the ratio shot up to almost 5, meaning that the same average family was suddenly spending close to $250,000 on a house. How was it possible that the same income suddenly have allowed a family to purchase a much more expensive home? I won’t go through the full analysis here, but the basic answer is: it wasn’t, and anyone who thought it was simply ignoring basic math.

In other words, the bubble occurred because people purchased homes they couldn’t really afford, and this fact would have been obvious if Americans, as a nation, had simply paid more attention to the math.

[2]

[2]Lest you think that this is a case of hindsight being 20/20, keep in mind that these kinds of data were available throughout the growth of the bubble. Anyone willing to think about it should therefore have known that the bubble would inevitably pop, and, indeed, you can find many articles from the time that pointed out this obvious fact.

(Next page: So how did everyone else manage to miss it?)

Although it’s tempting to blame the problem on a failure of “the system,” it was ultimately the result of millions of individual decisions, most of which involved a real estate agent arguing that prices could only go up, a mortgage broker offering an unaffordable loan, and a customer buying into the real estate hype while ignoring the fact that the mortgage payments would become outsized relative to his or her income. In short, many of us ignored the mathematical reality staring us in the face.

Perhaps I’m overly idealistic, but I believe that with better math education—and especially with more emphasis on quantitative reasoning—many more people would have questioned the bubble before it got out of hand. We can’t change the past, but I hope this lesson will convince you that we all need to get over being “bad at math.”

So with that in mind, I’ll urge you to start by making sure we recognize statements of being “bad at math” for what they are: a contagious social disease, which can be transmitted both from one adult to another and, far worse, from adults to children. After all, when a child hears an otherwise successful adult saying that he or she is “bad at math,” it’s natural for the child to assume that this must be OK.

For this reason, the first thing we must all do to stop the spread of the disease is to commit to never saying “I’m bad at math” (or similar) again. Even in the unlikely case that you actually are bad at math (and you’re probably better at it than you think), please don’t say it. We need kids to know that it’s no more acceptable to have a bad attitude toward math as toward reading, writing, or any other critical skill.

This piece is adapted from Chapter 1 of Math for Life (Big Kid Science, 2014) by Jeffrey Bennett, Ph.D. Read additional excerpts and learn more about the book at www.Math-for-Life.com, or visit the author’s website www.JeffreyBennett.com [3].